Helpful Tips Concerning Home Mortgages That Easy To Comply With

Article by-Flanagan DunnIf you are trying to decide on what mortgage company to choose, then maybe you could use a little extra help. You don't want to make a mistake, and there is no reason to feel overwhelmed. Keep reading to find out some very valuable information that can serve to help you locate the best mortgage.

Save enough money to make a down payment. Lenders may accept as little as 3.5% down but try to make a larger down payment. If you put down 20% of your total mortgage, you won't have to pay private mortgage insurance and your payments will be lower. You will also need cash to pay closing costs, application fees and other expenses.

You are sure to need to come up with a down payment. Certain lenders give approvals without a down payment, but that is increasingly not the case. You need to find out how much of a down payment is required before your submit your application.

You should have a work history that shows how long you've been working if you wish to get a home mortgage. Many lenders insist that you show them two work years that are steady in order to approve your loan. Changing jobs frequently can lead to mortgage denials. Do not quit your job while a loan application is in process.

When you see a loan with a low rate, be sure that you know how much the fees are. Usually, the lower the interest rate, the higher the points. These are fees that you have to pay out-of-pocket when you close your loan. So, be aware of that so you will not be caught be surprise.

Before picking a lender, look into many different financial institutions. Ask loved ones for recommendations, plus check out their fees and rates on their websites. Once read this article have a complete understand of what each offers, you can make the right choice.

Mortgage rates change frequently, so familiarize yourself with the current rates. You will also want to know what the mortgage rates have been in the recent past. If mortgage rates are rising, you may want to get a loan now rather than later. If the rates are falling, you may decide to wait another month or so before getting your loan.

There are many different types of home mortgage loans available, and some are much easier to get than others. If you are having a problem getting a conventional loan, try applying for an adjustable rate mortgage or a balloon. These are short term loans ranging from one to 10 years, and need to be converted when they expire.

Choose your mortgage lender many months in advance to your actual home buy. Buying a home is a stressful thing. There are a lot of moving pieces. If you already know who your mortgage lender will be, that's one less thing to worry about once you've found the home of your dreams.

If you are thinking abut changing jobs, try to wait until after your loan approval process is over. This is because the underwriter will have to go through the employment verification process all over again. They will also require you to submit paycheck information, which means that you would have to put the loan off until after you are paid a few times.

Many computers have built in programs that will calculate payments and interest for a loan. Use the program to determine how much total interest your mortgage rate will cost, and also compare the cost for loans with different terms. You may choose a shorter term loan when you realize how much interest you could save.

If you are a first time home owner, get the shortest term fixed mortgage possible. The rates are typically lower for 10 and 15 year mortgages, and you will build equity in your home sooner. If you need to sell you home and purchase a larger one, you will have more cash to work with.

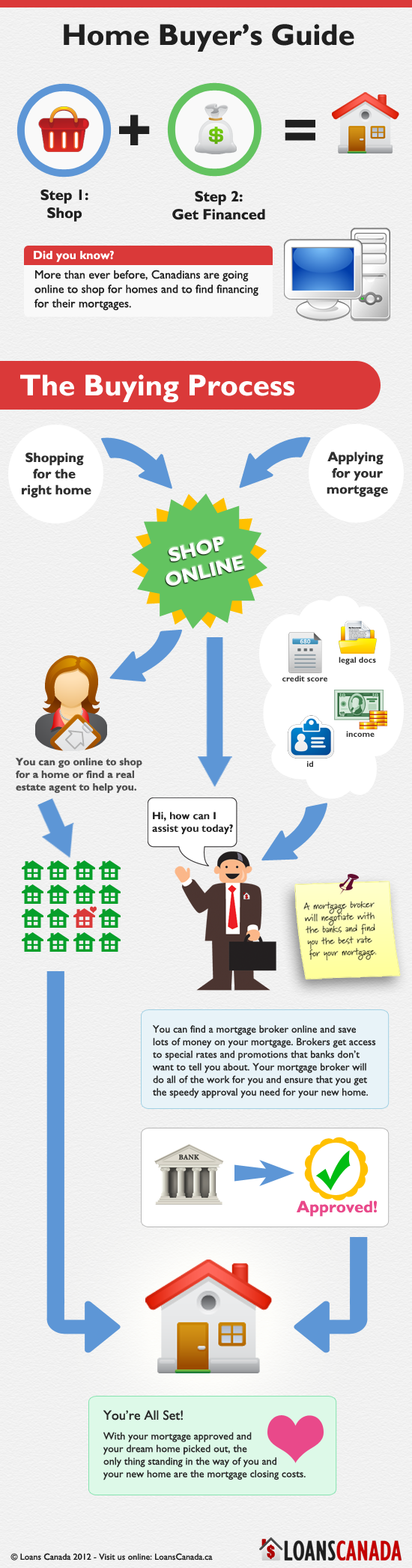

A mortgage broker can be a good alternative if you are finding it hard to get a mortgage loan from a credit union or regular bank. Mortgage brokers often are able to obtain financing other lenders cannot obtain. They check out multiple lenders on your behalf and help you choose the best option.

Before applying for a home mortgage, get your debts in order. Consolidate small debts with high interest rates and put a solid effort into paying them off. Do not take on new debt while you are preparing to apply for a home mortgage. The cleaner your debt record when you apply for a home mortgage, the better your chances of getting approval for a good loan at a good rate.

A fifteen or twenty year loan is worth investigating if you can manage the payments. These shorter-term loans have a lower interest rate and a slightly higher monthly payment for the shorter loan period. You might be able to save thousands of dollars by choosing this option.

Before you select a mortgage broker, do a check at the BBB. There are predatory brokers that can trick you into loans with higher fees and some refinancing options that earn them higher fees. Be https://fortune.com/2021/07/29/credit-suisse-report-archegos-loss-bank-massive-culture-problem/ of any broker who demands that you pay very high fees or excessive points.

If your mortgage is up for renewal, you should consider other lenders. As long as your mortgage isn't renewed, you won't face any penalties for switching to another company, unless there is a fee for paying off the mortgage in full. Thankfully, most lenders will cover that cost just for moving to them.

Compare the loan origination fees. There is more to a loan than just the interest rate that you agree to. Points are applied to the loan as well, and can mean a great deal when it comes to what your total cost will be on your home mortgage. Keep this in mind from the start.

While the process of getting a mortgage can be daunting, the results are well worth it. As you move into your home, you'll realize your dreams are finally achieved. Home ownership brings great responsibility and rewards, so enjoy it all yourself by using the tips above and getting a great mortgage.